monterey county property tax rate 2020

Access services online and contact state leaders Visit tngov. Look up the current sales and use tax rate by address.

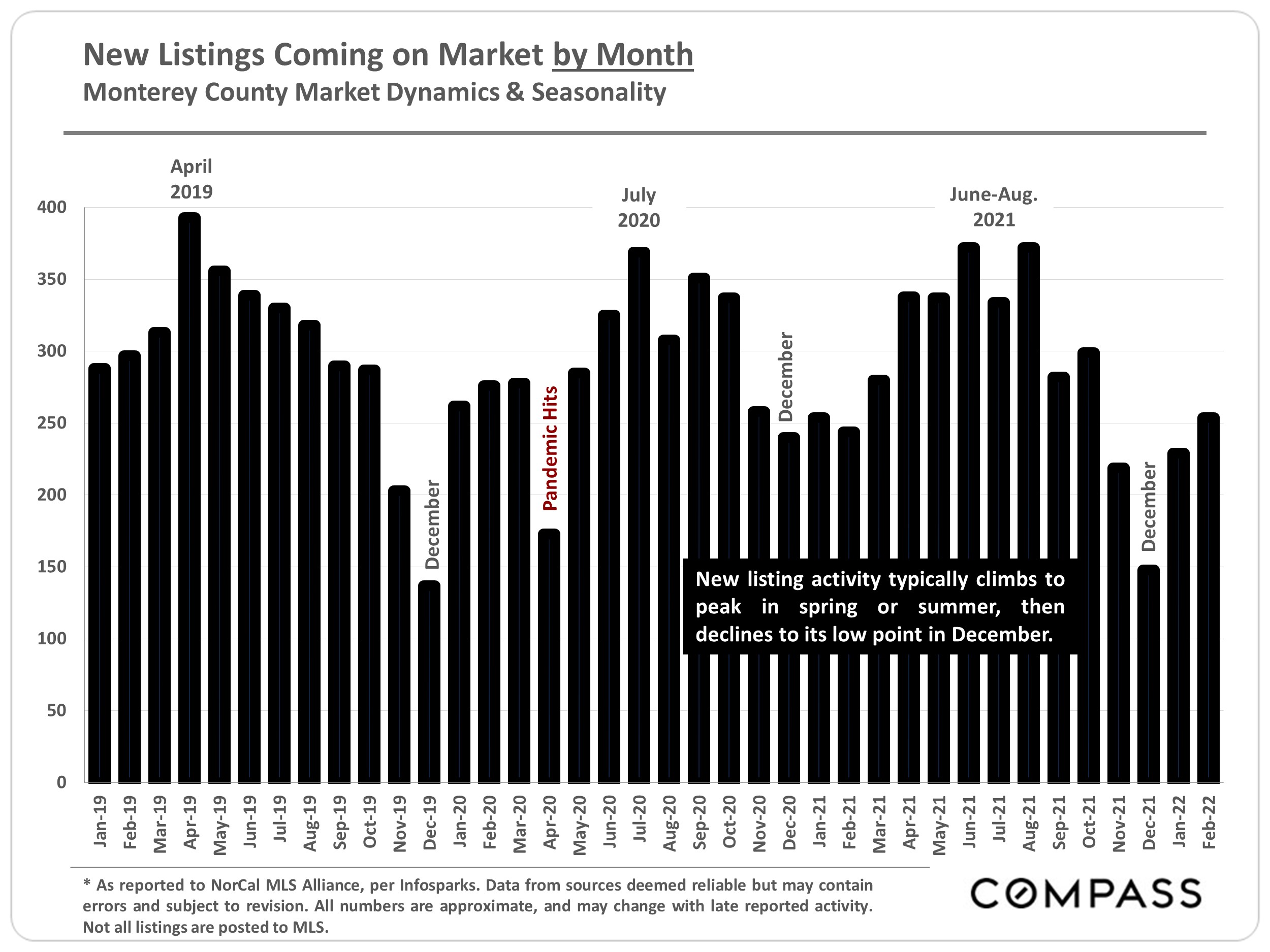

Monterey County Home Prices Market Trends Compass

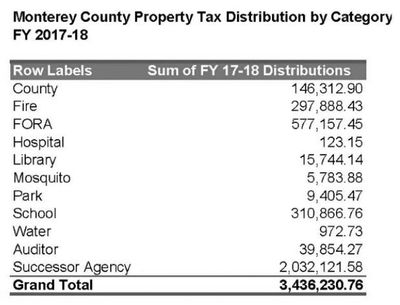

On February 1 2012 per AB103 Redevelopment Agencies in the State of California were dissolved.

. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. It was approved. Search Valuable Data On A Property.

435 Main Rd PO. The sales tax jurisdiction name is Monterey Conference Center Facilities District which may refer to a local government division. Along with the countywide 072 tax rate homeowners in different cities and districts pay local rates.

Visit Putnam County TN for more information about the area Visit Putnam County. 1-831-755-5057 - Monterey County Tax Collectors main telephone number. New Direct Charges - For new agencies with new direct charges to be placed on the property tax bill please contact Audptaxcomontereycaus for further information.

The minimum combined 2022 sales tax rate for Monterey County California is. Choose Option 3 to pay taxes. The Monterey County sales tax rate is.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in revenue for the County public schools cities and districts. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

Only current year taxes may be paid by phone. The California state sales tax rate is currently. Yearly median tax in Monterey County.

This table shows the total sales tax rates for all cities and towns in. Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. Monterey County collects on average 051 of a propertys assessed fair market value as property tax.

Such As Deeds Liens Property Tax More. Town of Monterey MA. Monterey County Property Records are real estate documents that contain information related to real property in Monterey County California.

Subsequently Successor Agencies were formed to conclude any. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services in the collection of property taxes. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in revenue for the County public schools cities and districts.

Monterey County has one of the highest median property taxes in the United. The property tax rate used by the Auditor-Controller include. 630 PM PDT Apr 8 2020.

775 Is this data incorrect The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc. There is much to discover. You will need your 12-digit ASMT number found on your tax bill to make payments by phone.

Start Your Homeowner Search Today. Revenue from hotel tax dropped from 286 million in. See upcoming events in Putnam County and get connected.

Election dateMarch 3 2020. PROPERTY TAXES IS THIS FRIDAY. The 925 sales tax rate in Monterey consists of 6 California state sales tax 025 Monterey County sales tax 15 Monterey tax and 15 Special tax.

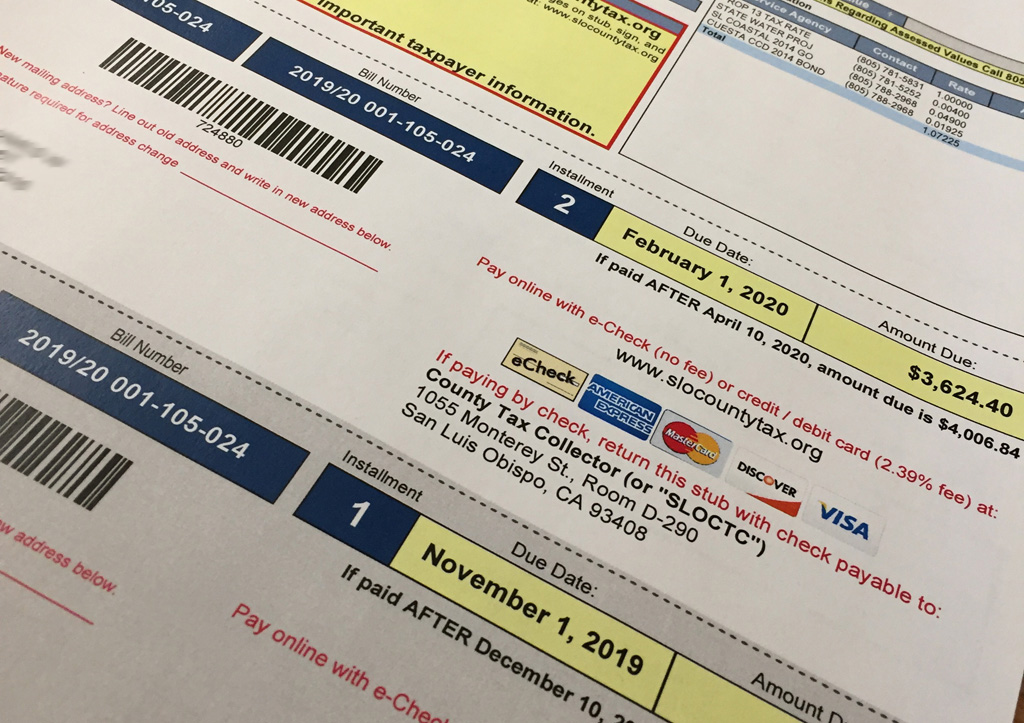

Hotel or transient occupancy taxes were more resilient than originally estimated according to the countys forecast. Below is an example and description of the information you can find on your property tax bill. The median Los Angeles County homeowner pays 3938 annually in property taxes.

A sales tax measure was on the ballot for Monterey city voters in Monterey County California on March 3 2020. Monterey County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax. To afford a single-family home in Monterey County priced at the median of 885500 most loans would require at least a 20 down payment of 177000 for a 30-year 442 interest fixed-rate.

Page 7 Property Tax Highlights FY 2020-21. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. Box 308 Monterey MA 01245 Phone.

Below is a list of the top ten taxpayers in Monterey County for Fiscal Year 2020-21. Monterey County collects on average 051 of a propertys assessed fair market value as property tax. The average effective property tax rate in San Diego County is 073 significantly lower than the national average.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. For assistance in locating your ASMT number contact our office at 831 755-5057. 051 of home value.

The 2018 United States Supreme Court decision in. Ad Get In-Depth Property Tax Data In Minutes. California has a 6 sales tax and Monterey County collects an additional 025 so the minimum sales tax rate in Monterey County is 625 not including any city or special district taxes.

The California state sales tax rate is currently 6. A no vote opposed increasing the citys sales tax by 05 percentage points for nine years. Tax Rate Book for Fiscal Year 2021-2022.

This is the total of state and county sales tax rates. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value. IN MONTERE COUNTY THE TAX COLLECTOR THERE SAYS HER OFFICE IS BEIN FLOODED WITH CALLERS ASKING IF.

A yes vote supported increasing the citys sales tax by 05 percentage points for nine years.

Property Tax By County Property Tax Calculator Rethority

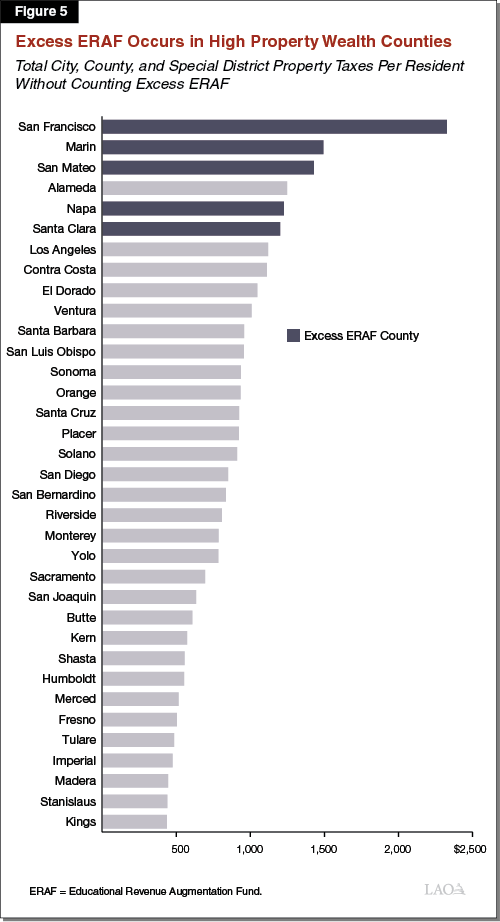

Excess Eraf A Review Of The Calculations Affecting School Funding

Monterey County Schools Coping With Declining Enrollment Monterey Herald

Property Tax By County Property Tax Calculator Rethority

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Property Tax Rates Berkshirerealtors

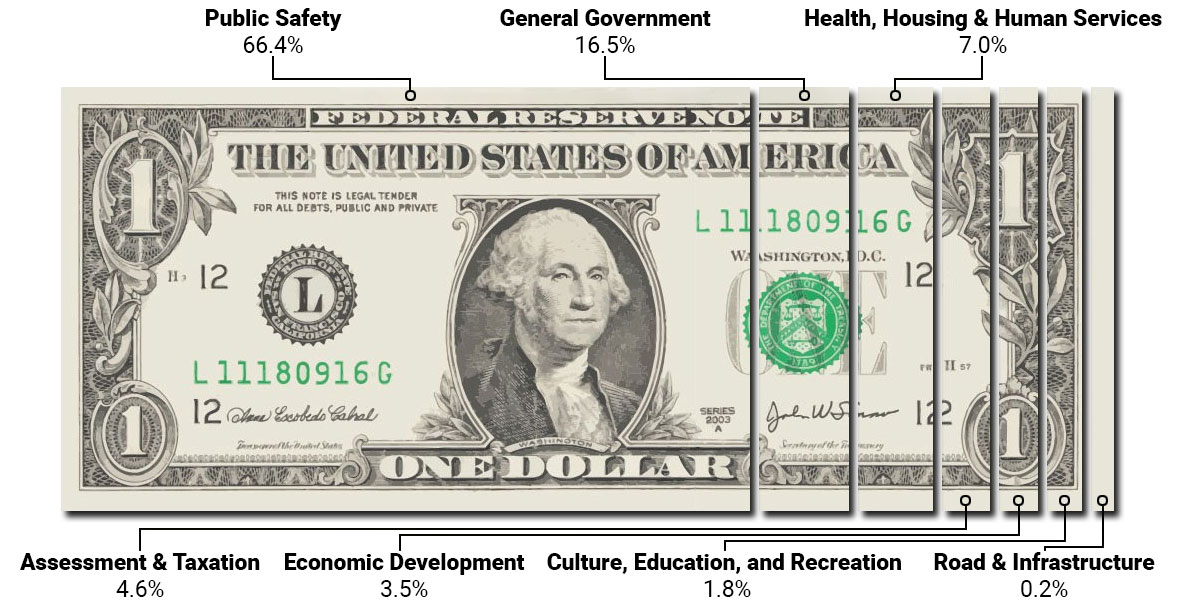

Assessment And Taxation Clackamas County

First Installment Payments For 2019 20 Secured Property Tax Bills Are Due November 1st County Of San Luis Obispo

Additional Property Tax Info Monterey County Ca

Monterey Peninsula Chamber Of Commerce Montereychamber Twitter

Monterey County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Monterey California Ca 93943 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders