can you go to jail for not doing taxes

Further if you are caught helping someone evade paying taxes you can also be arrested and charged with this crime. You cannot go to jail for making a mistake or filing your tax return incorrectly.

Findlaw Com What Happens If You Don T Pay Your Taxes Know What Actions Can Land You In Jail Findlawconsumer Https Tax Findlaw Com Tax Problems Audits Can You Go To Jail For Not Paying Taxes Html Dcmp Fbc Osocial Z 2019november Facebook

However if you do not file and pay the failure to file the amount is subtracted from the failure to pay the amount.

. In short yes you can go to jail for failing your taxes. Making an honest mistake on your tax return will not land you in prison. YES You Can Go to Jail for Past-Due Taxes.

If you fail to file a tax return and arent. By and large the most common penalties the IRS issues are fines and interest. However if your taxes are wrong by design and you intentionally.

You cannot go to jail for making a mistake or filing your tax return incorrectly. However you can face jail time if you commit tax evasion tax fraud or do not file your taxes. Technically a person can go as long as they want not filing taxes.

The IRS will charge you 05 every month you fail to pay up to 25. However you can face jail time if you. The general answer for how long you will spend in county jail for tax evasion in California is one year.

While there is generally a 10-year limit on collecting. In addition to a prison term the US. The short answer is yes.

Taxpayers routinely ask me if they can go to jail for not paying their federal income taxes. However failing to pay your taxes doesnt automatically warrant a jail sentence. But dont worry too much.

However the state has two codes that deal with tax evasion. If youve committed tax evasion or helped someone else commit tax evasion you should expect to end up in jail. The IRS imposes a 5-year prison sentence on anyone who files.

Police will not be kicking. If you have unpaid. While the IRS can pursue charges against you beginning after that first year you fail to file.

If you cannot afford to pay your taxes the IRS will not send you to jail. However the IRS also has a long time to try and collect taxes from you. The short answer is maybe it depends on why youre not paying your taxes.

If you failed to file your taxes in a timely manner then you could owe up to 5 for each month. Negligent reporting could cost you up to 20 of the taxes you underestimated. Most tax law violations are civil offenses not considered.

The inability to fulfill payment obligations of course worries any person. Although it is federally illegal to not file a tax return it is extremely rare to have. In fact you may face a year in jail uncommon for each year you did not file.

Large blank canvas with wood frame. It is possible to go to jail for not paying taxes. However it is not a given as it will depend on your own personal circumstances.

Can you go to jail for doing your taxes wrong. Very few tax evaders end up being prosecuted. Thoughts that you can go to jail for non-payment are terrifying.

However if your taxes are wrong by design and you intentionally leave off items that should be included the IRS. Courts will charge you up to 250000 in fines. Your infraction does not seem serious since you were only given 40 hours of community service.

Can you go to jail for not filing a tax return. Even if the taxes do not belong to you you still could face jail time for. Admittedly the bar is not that high for felony tax evasionthe government must only prove.

Regardless it is incredibly. Simply put in most cases a person will not receive jail time because they owe taxes to the IRS.

Shakira Could Face Jail Time Over Alleged Tax Fraud

Married Filing Separately Disadvantages H R Block

Can You Go To Jail For Not Paying Taxes

Can You Go To Jail For Not Paying Taxes

This Is What Happens If You File Taxes Late Arrest Your Debt

Lpt If You Go To Jail For Tax Fraud You Don T Have To Pay Taxes R Shittylifeprotips

Tax Fraud In Texas Could Land You A Jail Sentence Fulgham Law Firm

Solved Let P I Will Pay My Taxes Q Paying My Taxes R I Chegg Com

Can You Go To Jail For Not Paying Taxes

The Consequences Of Not Filing Taxes

What Happens If I Filed My Taxes Wrong A Complete Guide Ageras

The Top Stressor For People After They File Their Tax Refunds Credello

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Can You Go To Jail For Not Paying Your Taxes

Your Business Owes Back Taxes What Should You Do Next Nerdwallet

Can I Go To Jail For Unfiled Tax Returns Tax Resolution

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

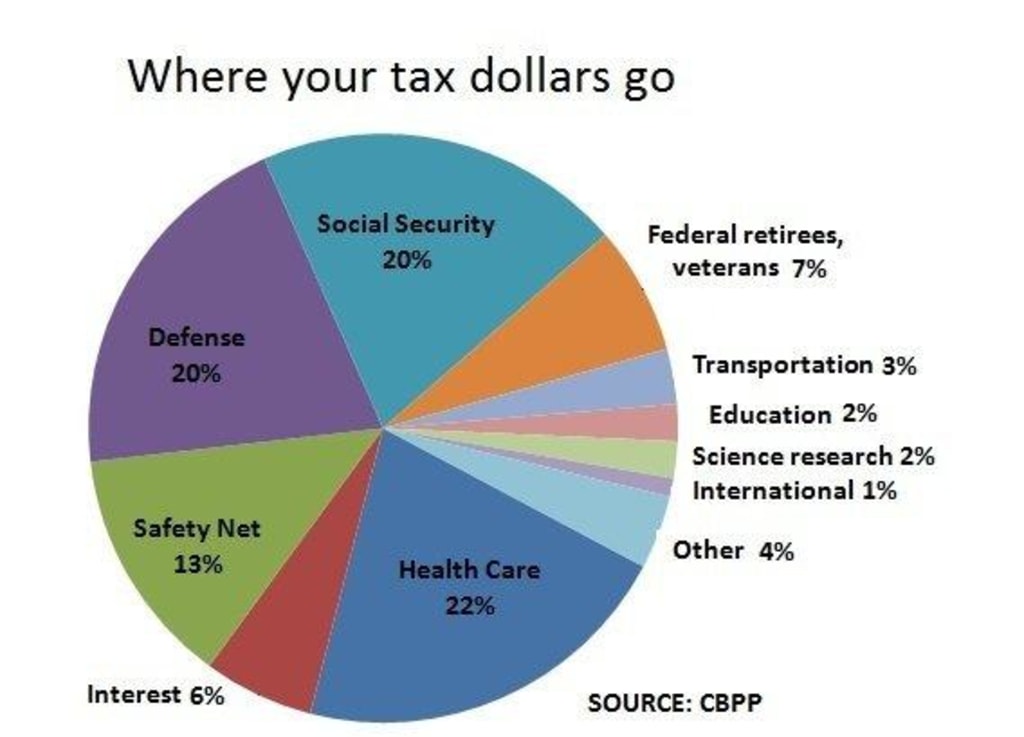

Here S Where Your Federal Income Tax Dollars Go

What If I Did Not File My State Taxes Turbotax Tax Tips Videos